South Korea’s Ministry of Trade, Industry and Energy recently designated a major offshore wind farm close to Sinan in Jeollanam-do province, which has encountered significant opposition. Opponents question whether the initiative was expedited too soon before the upcoming presidential elections. With projected investments exceeding 20 trillion won (around $14 billion), worries about the country’s overstretched electrical distribution network intensify. Experts particularly highlight potential issues with the nationwide power grid, specifically concerning how well-equipped the current system is for managing extra demand between energy-producing centers in the east and southwest and the densely populated Greater Seoul region. There have even been instances where certain power stations had to halt their activities because they couldn’t transmit enough electricity.

Moreover, the economic pressure on Korea Electric Power Corporation (KEPCO) cannot be overlooked; they must buy back the produced energy from the new facility at premium prices and contribute approximately 200 billion won ($139 million) yearly toward regional government grants. This burden might result in increased utility fees for end-users according to detractors. “I find it perplexing that such decisions were made so hastily right around election time,” remarked a professional within the sector.

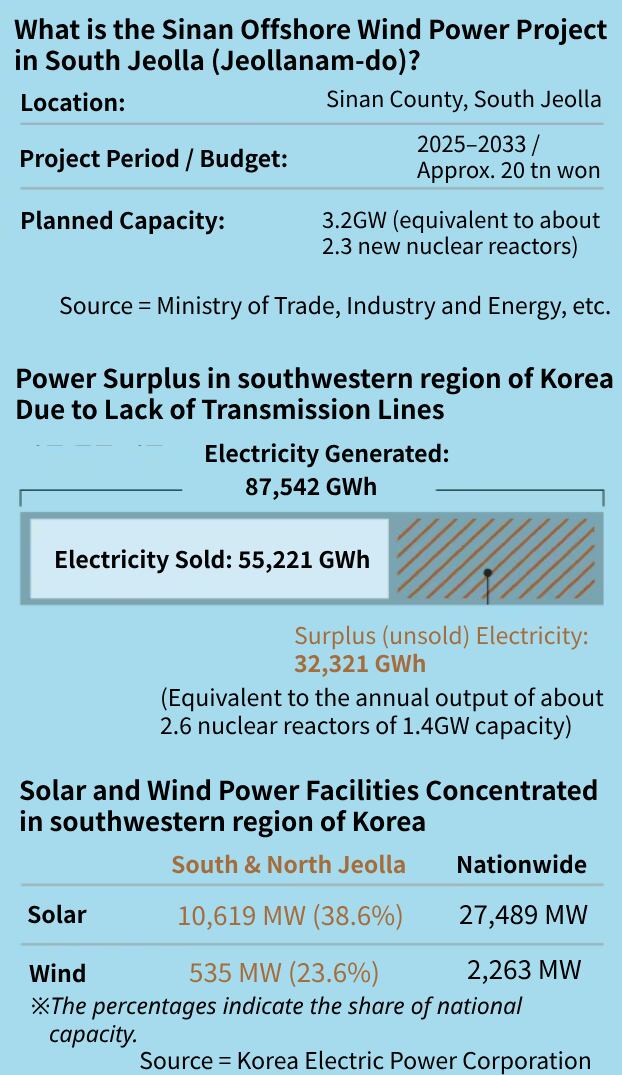

On April 22nd, the Ministry officially labeled the 3.2-gigawatt (GW) Sinan offshore wind project as part of a “renewable energy clustering zone.” This initiative has a greater capacity than both Shin Hanul nuclear power plants currently being built, each having a capability of 1.4 GW, and it outstrips the cumulative capacity of all offshore wind projects in South Korea that have successfully completed competitive bidding processes so far, totaling 2.7 GW.

The clustering zone framework empowers local administrations to drive the development initiative, choose appropriate offshore locations, and interact closely with both residents and fishing groups. As compensation, towns receive a portion of the revenue generated from electricity sales and gain advantages through consolidated infrastructure projects like power grid connections, which reduces the economic strain on individual developers. This approach aims to accelerate the progress of renewable energy ventures by promoting collaborative local involvement and tackling disjointed endeavors within the commercial sphere. An example includes a 1.4 GW offshore wind scheme covering areas in Buan and Gochang within Jeollabuk province, which was approved using this method back in February.

Critics contend that the Sinan project is not a suitable recipient for such incentives, asserting that it simply merges formerly struggling private enterprises into a single entity without addressing fundamental problems. They also speculate about potential political motives behind the timing. “What’s the reason for labeling a project initiated in 2019 only now, shortly before the election?” questioned an informant. In response, the government insists that all procedures were properly followed, emphasizing that Jeollanam-do officially filed the application back in November.

The dispute has escalated against the backdrop of wider electricity grid issues. Multiple coal-powered stations on the eastern seaboard are inactive because of insufficient transmission capabilities to reach the main urban areas. Across the country, projects for building new transmission and distribution networks often face delays, occasionally stretching into several years. Against this setting, detractors argue that the administration’s plan to expand offshore wind energy relies on overly optimistic assumptions that ignore present constraints within the electrical grid system.

A major point of worry is the proposed high-voltage direct current (HVDC) power line slated for installation along the western coastline, which is seen as essential for easing congestion in the southwest area. It remains uncertain if this initiative will proceed according to plan.

As things stand, approximately 80 percent of the 2.7 gigawatts of offshore wind power capacity secured via auctions since 2022 is located in Jeollanam-do. Experts warn that adding yet another major project in this area might put additional pressure on the transmission infrastructure.

Based on the figures from 2024, the southwestern region produced 87,542 gigawatt-hours (GWh) of electrical energy yet utilized only 55,221 GWh, resulting in roughly 40 percent of its production being redirected to different areas nationwide. Even with this disparity, the count of transmission lines connecting the southwest to the Seoul district remains unchanged. Specialists caution that the Sinan initiative might cause comparable grid congestions, which have previously prompted the closure of several eastern coastal power stations.

“If we do not increase our transmission capabilities alongside the development of new power-demand sites such as data centers, this generated electricity will have nowhere to be utilized,” stated Professor Park Jong-bae from Konkuk University.